Find out which countries will join the Eurozone in the next few years, and which countries are unlikely to ever join the Euro. Are there countries that may be leaving the Euro? And how likely is it that the European Union’s single currency will collapse?

This edition of Currency Facts focuses on the future of the Eurozone. Brought to you by our team of currency experts at Leftover Currency.

Which countries are currently in the Eurozone?

The group of EU countries that have adopted the Euro as their national currency is called the euro area, also called the eurozone. Not all of the 27 European Union member states have the Euro as their national currency. At the moment, the eurozone consists of the following 19 countries:

- Austria

- Belgium

- Cyprus

- Estonia

- Finland

- France

- Germany

- Greece

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Portugal

- Slovakia

- Slovenia

- Spain

In addition to the eurozone countries, three small countries have concluded monetary agreements with the EU: Monaco, San Marino and Vatican City also use the Euro as their national currency.

In addition to the eurozone countries, three small countries have concluded monetary agreements with the EU: Monaco, San Marino and Vatican City also use the Euro as their national currency.

Will more countries join the Eurozone?

Eight countries are part of the European Union but are not part of the Euro area: Bulgaria, Croatia, Czechia, Denmark. Hungary, Poland, Romania and Sweden. Denmark has negotiated an opt-out from the Euro. The other countries have committed to joining the euro area as and when they meet the conditions for entry to the euro area.One of the entry conditions for a country to join the euro area is to participate in the second version of the European Exchange Rate Mechanism (ERM-II) for two years before joining the Euro. This requires the country to pass the ERM-II legislation. As a result, countries can decide not to approve ERM-II laws and thereby not meet the entry conditions for the euro area.

There is no deadline for the remaining EU countries to join the euro area. Some countries, such as Poland and the Czech Republic, have made it clear that they don’t plan to join anytime soon. Other countries, including Bulgaria, Croatia and Romania, are expected to join the Eurozone in the near future. We look at this in more detail in what follows.

Which countries will join the Eurozone in the near future?

Three EU countries that are currently outside the euro zone will adopt the Euro as their national currency in the next couple of years: Bulgaria, Croatia and Romania.When will Bulgaria join the Eurozone?

The IMF’s managing director had confirmed that Bulgaria was on track to adopt the Euro as its national currency in 2023. It was originally expected that Bulgaria would pass ERM-II legislation by 30 April 2020, and that the country could join the euro area on 1 January 2023. The ECB has reviewed this decision and has recently confirmed that Bulgaria will join the Euro zone on 1 January 2024.

When will Croatia join the Eurozone?

Croatia’s government had indicated that it expected to pass the ERM-II legislation by May 2020. It was indeed able to do so. The ECB has confirmed that Croatia will join the Euro on 1 January 2023, as discussed in our blog article about Croatia joining the Euro.

When will Romania join the Eurozone?

Romania’s government has set 2024 as its target to join the Eurozone. However this was labelled to be ‘very ambitious‘ by the country’s Finance Minister. It’s not the first time that the country’s entry date to the euro area was postponed.

Which countries may join the Eurozone in a more distant future?

A number of countries are candidates to join the European Union. New EU member states are expected to adopt the Euro as their national currency when they meet the entry conditions for the euro area. These are countries that may join the EU in this decade or the next one, and that may join the Eurozone in a more distant future:Albania and the Eurozone

Albania’s Prime Minister has confirmed that Albania is still committed to EU membership following France’s veto in 2019. The EU’s new enlargement process puts the country back on track towards joining the EU. A date hasn’t been set and it’s likely that it will take the country a considerable amount of time to meet the Eurozone’s entry conditions.

Bosnia Herzegovina and the Eurozone

Bosnia is a potential candidate for EU membership. While it’s likely to take several more years before the country joins the EU, and many more before joining the Eurozone, the country’s currency, the Bosnian Convertible Mark, is already linked to the Euro in a way: It’s still pegged to the old Deutsche mark, Germany’s old currency which was replaced by the Euro.

Kosovo and the Eurozone

Like Bosnia, Kosovo is a potential candidate for EU membership. Furthermore, the country is already using the Euro as its national currency. But this is done unilaterally, without the EU’s blessing. The country is not allowed to issue its own euro coins and banknotes. It’s likely to take at least a decade before Kosovo may become an official Eurozone member.

Montenegro and the Eurozone

Montenegro is a candidate country for EU membership. Like Kosovo, the country is already using the Euro as its national currency. Similar to Kosovo this is done in a unilateral way. Once Montenegro is able to meet the Eurozone’s entry conditions it’s likely that the country will become an official member of the Eurozone.

North Macedonia and the Eurozone

Since the country has been renamed North Macedonia, it’s back on track to join the EU in the not so distant future. Bordered by three countries using the Euro (one of which unofficially), it’s likely that North Macedonia will aim to adopt the Euro as its national currency sooner rather than later, if it can meet the Eurozone’s entry criteria.

Serbia and the Eurozone

Serbia is a candidate country for EU membership. The country’s National Bank was praised by JP Morgan when it judged the Serbian Dinar a realistically valued currency. This may be a signal that Serbia will be on its way to meet the Eurozone’s entry criteria in a not too distant future.

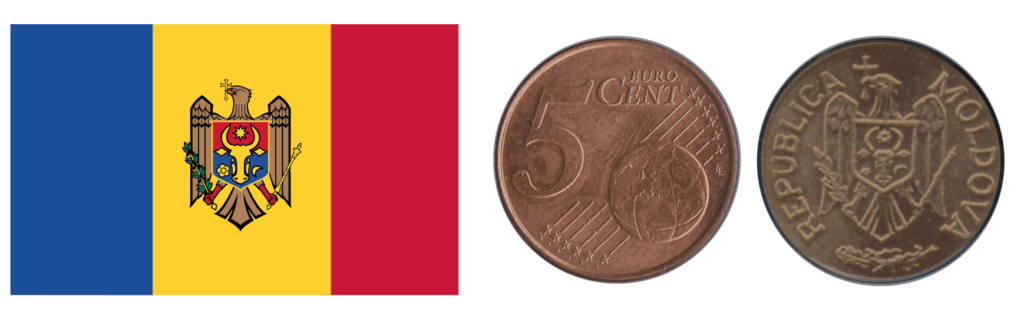

Moldova and the Eurozone

Moldova is not a candidate for EU membership. The country neighbours Romania, which is an EU member and expected to join the Eurozone in the near future. Some parties in Moldova are in favour of (re-)unifying the two countries, which share the same language. Should the two Romanian-speaking countries form a political union, a fast track for Moldova into the EU and potentially the Eurozone would be for the country to become part of Romania. If this were to happen, Moldova’s national currency could become the Euro in the not too distant future.

Should the two Romanian-speaking countries form a political union, a fast track for Moldova into the EU and potentially the Eurozone would be for the country to become part of Romania. If this were to happen, Moldova’s national currency could become the Euro in the not too distant future.Northern Ireland and the Eurozone

Another country where re-unification may be on the cards is Northern Ireland. Northern Ireland’s enforced Brexit has increased calls for a unity poll, a referendum on reunification. If such a unity poll were held, and if Northern Ireland voted to re-unite with the Republic of Ireland, the Euro would instantly become the national currency of a united Ireland.

Ukraine and the Eurozone

Ukraine has made progress towards EU integration with the Ukraine–European Union Association Agreement. Whether the country will become a candidate for EU membership will depend on political will on both sides. It’s unlikely that Ukraine will join the Eurozone in the next 10 years but it’s possible it could happen in the 2030’s, if the political will is there.

Which countries are not likely to join the Eurozone any time soon?

Denmark has opted out of the Euro and won’t join the single currency in the foreseeable future. There is no political will to join the Eurozone in Poland, the Czech Republic, Hungary and Sweden and it’s therefore unlikely that these countries will join the euro area any time soon.In addition it’s unlikely that the following countries will one day have the Euro as their national currency:

Australia and the Eurozone

As far away as Australia is from Europe, the country has since 2015 participated in the Eurovision Song Contest. However there is absolutely zero chance that Australia will join the 19 other European member states of the Eurozone.

Scotland and the Eurozone

Even if Scotland becomes an independent country, and even if the country rejoins the European Union, it is unlikely that Scotland will join the Eurozone anytime soon. The currency of an independent Scotland is likely to remain the (Scottish) Pound.

Will some countries leave the Eurozone?

During the European Debt Crisis, starting in 2009, a number of Eurozone countries had serious financial problems and had to be bailed out. If these bailouts wouldn’t have happened, many analysts believe that Greece, Italy and possibly Cyprus could have crashed out of the Eurozone. However this did not happen and Greece’s bailouts successfully ended in 2018.Here are the main reasons why a country could leave the Eurozone:- a Eurozone country cannot repay its debts and is forced out of the Eurozone

- a Eurozone country decides to leave the Eurozone, while staying in the EU, following a referendum

- a Eurozone country decides to leave the European Union following a referendum

- a Eurozone country ceases to exist, or a part of it declares independence and becomes a new country

All countries that were bailed out during the European Debt Crisis have returned to business as normal. However it is possible that external evens, such as the Coronavirus (COVID-19) will trigger a new European Debt Crisis. If this happens, it will likely be the same countries that will first run into problems: Greece and Italy.

There are no referenda planned for countries to either leave the Eurozone or to leave the EU. Support for EU membership is above 80% in most EU countries. The public support for the Euro in Eurozone countries is a solid 76%.

Eurozone countries ceasing to exist are the next type to look at, and here may be a few candidates for countries or regions that may leave the Eurozone in a not too distant future:

Belgium's possible breakup and the Euro

Belgium has been without a government since December 2018. Elections in May 2019 have so far not produced a working coalition. If the government formation fails, the country will call new elections. If new elections cannot solve the problem and if the two Flemish nationalist parties get a large share of the Flemish vote, events may lead to a possible breakup of Belgium, with Flanders becoming an independent country.A newly independent Flemish republic would have to re-apply to join the EU and the Eurozone. During a transition period there may be an agreement with the other euro area member states that would allow Flanders to use the Euro as its national currency, similar to the agreements made with Monaco, San Marino and Vatican City.In a worst case scenario Flanders could adopt the Euro unilaterally, similar to Kosovo and Montenegro. During this time the country can however not mint its own coins. The Belgian issued euro coins would remain legal tender in the whole Eurozone.

The remaining parts of Belgium, Wallonia, Brussels and the small German speaking Eupen-Malmedy region, may continue to exist as Belgium, or may form a new country, which could become the Kingdom of Wallonia. If the country of Belgium continues to exist in a smaller form it won’t need to re-apply to join the EU and the Eurozone. Any new country formed out of parts of Belgium will need to re-apply to both the EU and the Eurozone.

The remaining parts of Belgium, Wallonia, Brussels and the small German speaking Eupen-Malmedy region, may continue to exist as Belgium, or may form a new country, which could become the Kingdom of Wallonia. If the country of Belgium continues to exist in a smaller form it won’t need to re-apply to join the EU and the Eurozone. Any new country formed out of parts of Belgium will need to re-apply to both the EU and the Eurozone.

Catalonia and the Euro

Catalonia’s bid for independence may one day lead to the formation of an independent Catalan Republic. If this happens, Catalonia would need to re-join the EU and the Eurozone. Catalonia has the highest GDP of all Spanish regions and it is therefore likely that an independent Catalonia would quickly be able to meet the Eurozone’s entry criteria.

Will the Eurozone collapse?

The European Parliament’s Think Thank sent out this communiqué to mark a decade after the start of the European Debt Crisis in 2009:While signs of moderate recovery showed in 2014, the risk of falling into deflation or secular stagnation remained high, and it was only in 2017 that the EU economy returned to a state similar to that of before the crisis. The signs in 2019 are not so promising however. Many efforts have been made to improve resilience in the EU and the euro area. These have included improving the stability of the financial sector, strengthening economic governance, creating a safety net for sovereigns in distress and carrying out structural reforms, particularly in the countries most affected. In addition, the European Central Bank (ECB) has taken unconventional policy measures. Nonetheless many argue that the pace of the reforms has slowed down considerably since 2013 when the economic situation began to improve. The legacy of the crisis is still present and many challenges persist. These include the absence of a clear and agreed vision for the future of economic and monetary union (EMU), perennial macroeconomic imbalances and high public deficits in a number of Member States, and the ongoing risk of a doom loop between sovereigns and the banking sector. Post crisis vulnerabilities also include rising inequalities, youth unemployment and high in-work poverty risk levels.

Although the European Central Bank (ECB) has taken a number of measures to improve resilience in the EU and Eurozone, the legacy of the European Debt Crisis is still present and many challenges persist. External events, such as the Coronavirus (COVID-19) or a worldwide economic downturn due to trade disputes may trigger another ‘doom loop’ and may result in Eurozone countries having problems to repay their debts.

There are no reasons to believe that a collapse of the Eurozone is foreseeable in the near future. However, to avoid a possible collapse of the Eurozone in times to come, much will depend on how the ECB and the Eurozone’s member states will be able to agree on a shared vision for the future of the Economic and Monetary Union (EMU).

Loading

Loading